In the ever-evolving healthcare landscape, member retention is crucial for maintaining consistent revenue streams and enhancing health outcomes. Want to keep your members? Understanding why they voluntarily disenroll in the first place can help healthcare organizations develop effective retention strategies for retaining them now and into the future.

This article examines the data surrounding members’ voluntary disenrollment and the most effective measures we have found to retain them.

What Does the Data Tell Us? Understanding Voluntary Disenrollment

To predict and prevent member disenrollment, we must first analyze data from those who have already left. This historical data provides insights into past trends, helping us apply these learnings to current members. The goal is to intervene before members choose to leave, as staying with a plan is often easier than transitioning to a new one.

Complex Clinical Profiles

- Multiple Chronic Conditions: Among members who voluntarily disenrolled, 23% had multiple chronic conditions, compared to 25% of those who stayed. Although the difference seems small, it was much larger a few years ago, indicating a shift.

- Behavioral Health or Substance Abuse Disorders: Today, 50% of disenrolled members have a behavioral health or substance abuse disorder, up from 35% in 2019-2021. This increase highlights the growing complexity of members’ health profiles.

- Combined Conditions: Members with both multiple chronic conditions and a behavioral health or substance abuse disorder now make up 15% of those disenrolling, compared to just 6% a few years ago.

Higher Preventable ED Visits and Pharmacy Costs

- Number of Medications: Disenrolled members take an average of 11 medications, compared to 7 for those who remain.

- Out-of-Pocket Pharmacy Costs: Disenrolled members face higher average out-of-pocket costs ($550 vs. $400).

- Preventable ED Visits: The rate of preventable emergency department visits is double for disenrolled members (24% vs. 13%).

Socioeconomic Factors

- Low Income Subsidy (LIS) Members: 18% of disenrolled members receive LIS, compared to 4% of those who stay.

- SDoH Issues: Disenrolled members are more likely to have social determinants of health issues, with 4.25% identified, compared to a much lower percentage in those who stay.

Membership Duration

- Members enrolled for less than 12 months are at higher risk of leaving, and their profiles increasingly resemble those of longer-term members.

Strategies to Impact Voluntary Disenrollment

Create Retention Transparency Through Predictive Analytics

While historical data like we above provide valuable insights on trends visible to the naked eye, because there are hundreds of factors surrounding a members’ eventual disenrollment all interwoven and interconnected, simple human observation and basic rules-based analysis are not going to be enough to truly identify members at risk of leaving. Advanced pattern recognition, powered by artificial intelligence (AI) and machine learning (ML), is essential.

Predictive analytics opens a lot of doors. These tools allow us to analyze historical data of disenrolled members and apply the learnings to an organization’s current population. These technologies analyze vast amounts of data, identifying risk factors that might be missed by human analysts. Each member is assigned a risk score based on their journey compared to millions of other member journeys, allowing for early identification of members at risk of leaving and for targeted retention efforts.

Tactical and Strategic Approaches to Retention

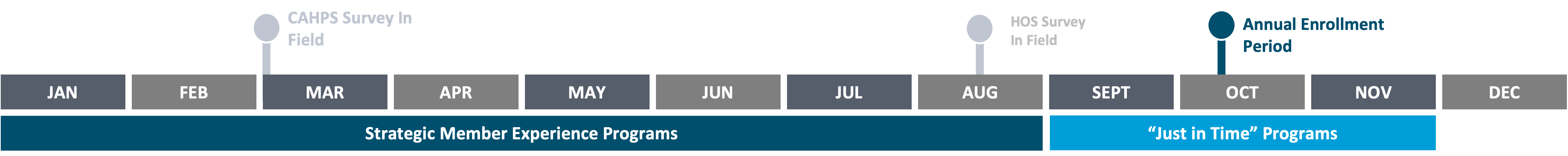

Once high-risk members are identified, a two-pronged approach is essential: Just-in-Time Outreach with before the Annual Enrollment Period and Strategic Member Experience Programs throughout the rest of the year.

Just-in-Time Interventions

Just in time interventions catch the members who are highly likely to leave the plan voluntarily right before the Annual Enrollment Period. By intervening with high-touch engagement personalized to their specific member persona, you can catch those members “just-in-time” to prevent them from leaving to another plan.

- Pre-Open Enrollment Outreach: Target members likely to leave with tailored communications addressing their specific concerns.

- Barrier Identification: Incorporate member-level CAHPS risk to identify each member’s barrier to continued enrollment (access, plan, provider satisfaction).

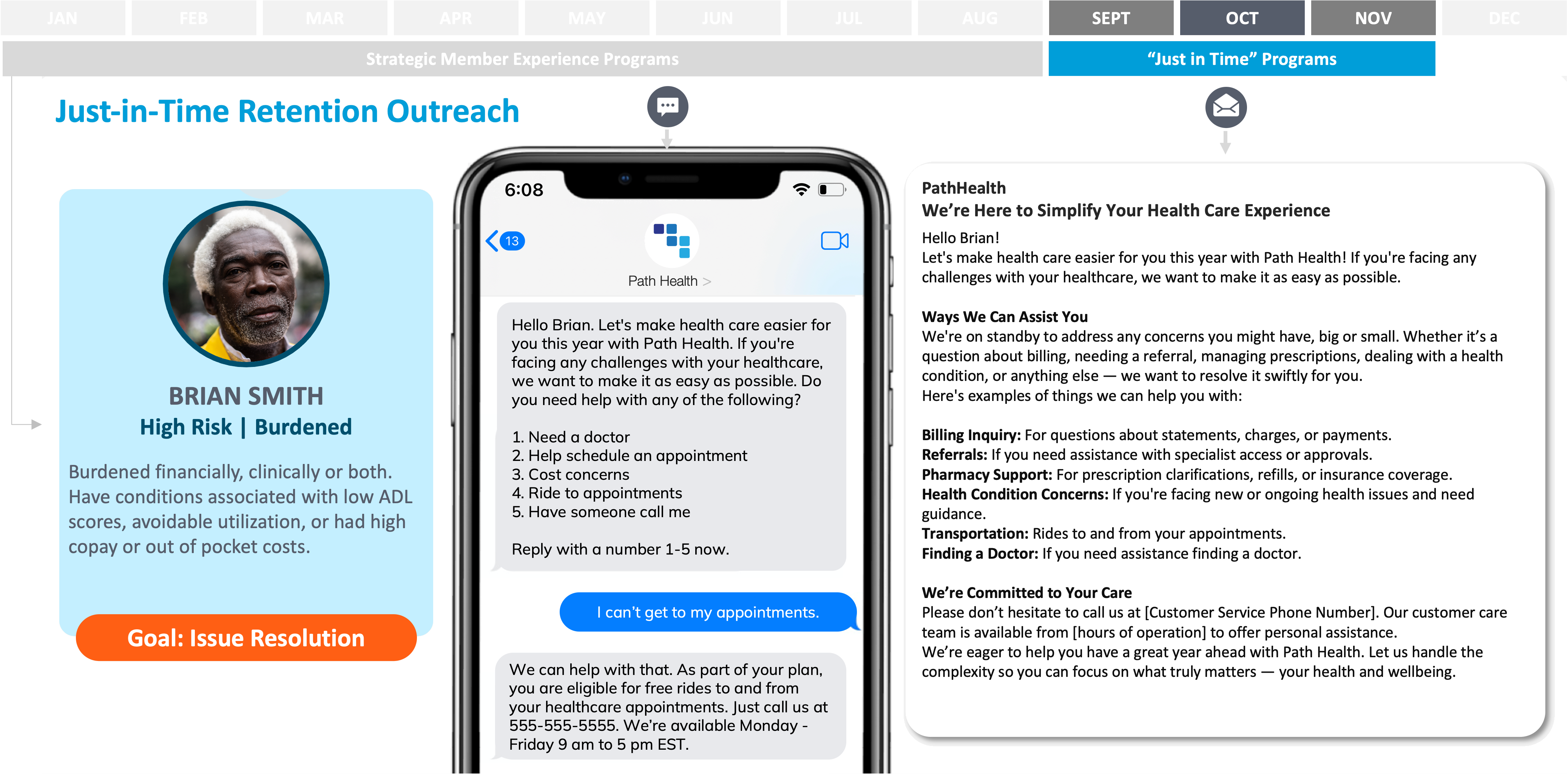

What does this look like in practice? The below interaction shows how Brian Smith, a high-risk burdened member can be outreached to within a Just-in-Time program to reduce the chance of disenrollment.

Integrated Member Experience Programs

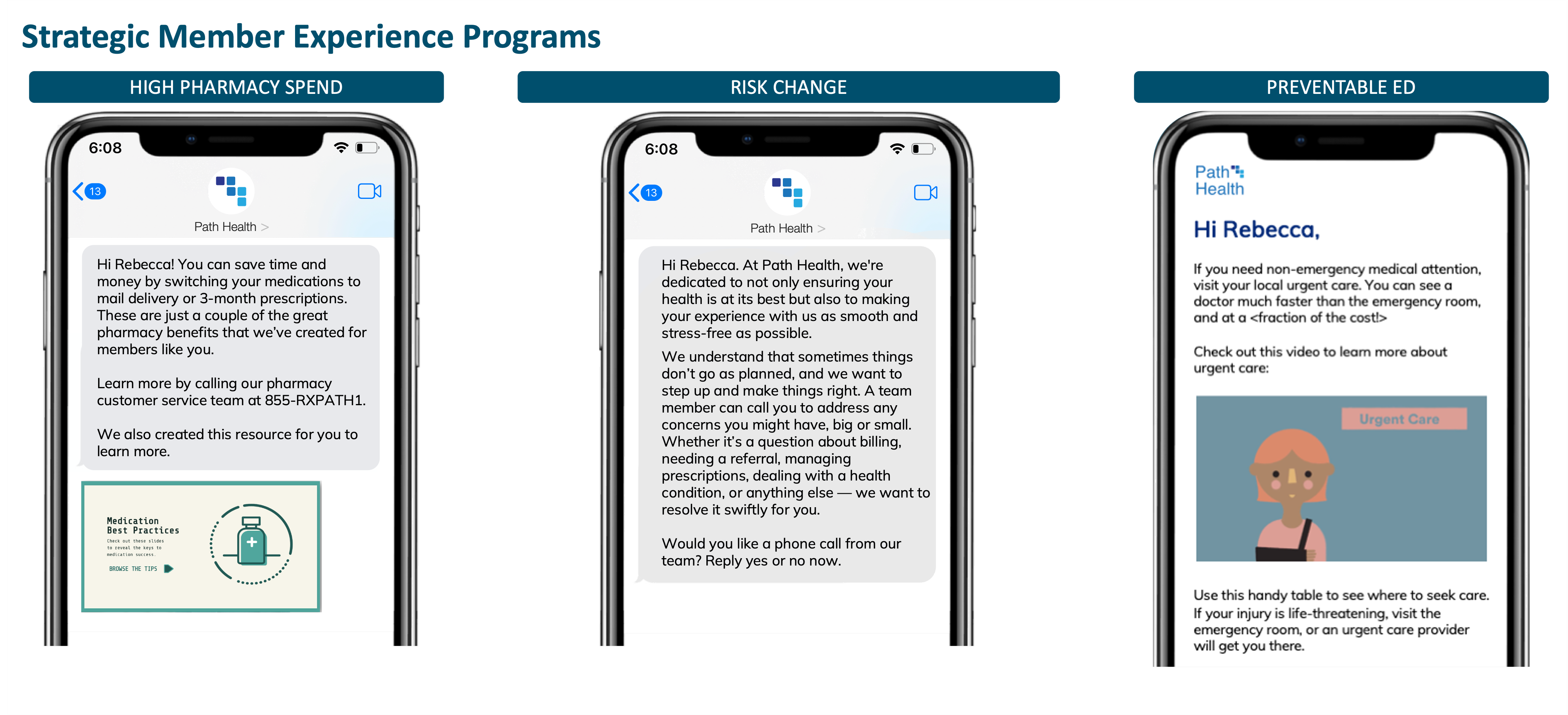

Implementing integrated member experience programs ensures that members receive consistent and meaningful communication throughout the year, which helps to address issues before they become reasons for disenrollment.

- Segment and Communicate: Tailor communications to address specific member concerns, emphasizing the ease of staying with their current plan.

- Monitor Inflection Points: Be proactive during significant events like ED visits, changes in doctors, or grievances, which can be correlated with disenrollment.

Retention Personas: Develop personas based on risk profiles to streamline targeting and engagement efforts.

- Year-Round Engagement: Regular check-ins and support, especially after key events like emergency visits or changes in health status.

Put into practice, you can see what this may look like below. Outreach for high pharmacy spend, risk change, and a preventable ED visit are all prime examples of Strategic Member Experience Programs.

Targeting and Segmentation

Proper targeting and segmentation are essential for effective retention strategies. Your personas will drive the type of communication your members should receive. For example,

- High-Risk | Aggrieved: Identified as having a grievance, complaint, appeal, or prior authorization in the prior year.

- High Risk | Burdened: Burdened financially, clinically or both. Have conditions associated with low Activities of Daily Living (ADL) scores, avoidable utilization, or had high copay or out of pocket costs.

- High Risk | Inexperienced with the Plan: Lack of engagement and/or interactions with the plan.

- High Risk | Clinically Engaged: Lower engagement with their PCP, and unengaged with their healthcare relative to their illness burden.

How many members should you target? Watch the on-demand webinar to learn the strategies behind determining your outreach volume.

When outreaching, remember:

- High-Risk: Prioritize outreach to high-risk members based on their risk scores.

- Retention Personas: Develop detailed personas to tailor communication and engagement strategies effectively.

- Strategic Messaging and Omnichannel Approach: Utilize various channels to reach members with the right message at the right time.

Easier to Stay Than to Leave

Changing healthcare plans can be a complex and daunting process for members. Encouraging members to stay with their current plan is often simpler and more beneficial for everyone involved. The goal is to make things easier and unburden patients so it’s easier for them to stay rather than leave.

Familiarity and Comfort

Members are already familiar with the providers, network, and benefits of their current plan. Switching plans requires them to navigate new systems, which can be confusing and stressful.

Continuity of Care

Staying with the same plan ensures continuity of care, which is crucial for members with chronic conditions or ongoing treatments. They can continue seeing the same doctors and accessing the same facilities without disruption.

Administrative Ease

Members avoid the administrative burden of transferring medical records, understanding new plan details, and managing changes in coverage. The transition process can be time-consuming and prone to errors.

Financial Stability

Switching plans might result in unexpected costs or changes in coverage for medications and services. Staying with the current plan provides financial predictability and stability.

Encouraging Members to Stay

To encourage members to stay with their plan, consider the following strategies:

Highlight the Benefits

Emphasize the advantages of staying with the current plan, such as familiar providers, seamless care, and stable costs. Provide clear and concise information about the benefits they enjoy.

Address Concerns Proactively

Use predictive analytics to identify members at risk of leaving and address their specific concerns. Offer solutions to any issues they might have, such as high out-of-pocket costs or access to certain providers.

Personalize Communication

Tailor communications to individual members based on their needs and preferences. Personalized messages are more likely to resonate and be effective in retaining members.

Enhance Member Experience

Focus on improving the overall member experience through better customer service, streamlined processes, and more engaging interactions. A positive experience can significantly impact member satisfaction and retention.

Talking CAHPS: Member Retention Edition

Conclusion

Understanding and addressing the complex needs of at-risk members ensures better outcomes for both the members and the organization. By leveraging advanced analytics and targeted retention strategies, healthcare providers can significantly reduce voluntary disenrollment rates. Implementing proactive measures not only enhances member satisfaction but also strengthens the overall stability of the healthcare plan.

Investing in predictive analytics and robust member engagement programs is essential for any healthcare provider aiming to maintain and grow their member base in today’s competitive environment. Your business, employees, and customers will benefit from a proactive approach to member retention.